MU is causing fans to go through this 'wow' to another 'wow', as they continue to be strong in the transfer market by pursuing both Benjamin Sesko and Carlos Baleba. The question is where the Red Devils get money to spend so terrible?

After the most harmful currency of the national currency in half a century, there was no place to attend Europe, the personnel was cut sharply, and only 5 months ago, a boss claimed the club “had bankruptcy without reducing the costs at Christmas”, many people thought the summer transfer period at Old Trafford would pass in quiet.

No.

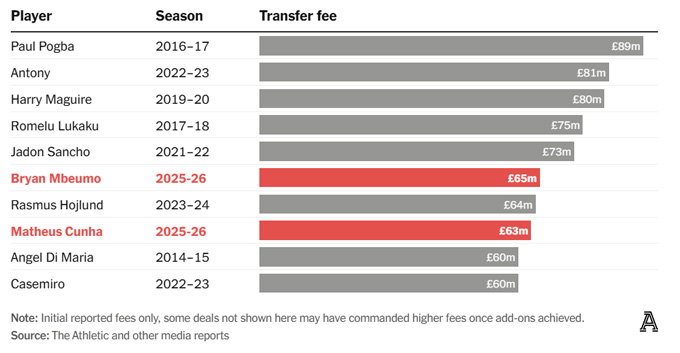

Particularly, the rookie Matheus Cuha and Bryan Mbeumo spent MU up to £ 127.5 million pounds only calculated for a fixed transfer fee. Although no player has not sold any players, the name MU still appears dense in the cult deals.

Despite the recent decline, the Red Devils are still one of the leading clubs in the world, at least on the pitch.

Currently, MU is approaching the agreement to recruit Benjamin Sesko from RB Leipzig. Latest, The Athletic revealed that Old Trafford's home team is also exploring the ability to recruit midfielder Carlos Baleba of Brighton.

Brighton is famous for being “high -handed” in negotiations, and has no intention of selling BaleBa this summer. Meanwhile, like Cunha and Mbeumo, Sesko is certainly not cheap. After Newcastle raised the buying price at the beginning of the week, MU immediately sent the first offer worth 75 million euros plus 10 million euros.

So, how can MU spend so big this summer? Although there is no revenue from the European Cup, the finance is being tightened, and so far no one has sold money, they still target the next “blockbuster” contracts.

The answer lies in two factors: profit and sustainable law (PSR), and the ability or access to actual cash flow.

PSR: The barrier is not too big

The issue of PSR used to be considered a big concern, but actually not as serious as imagination. As the Athletic analyzed in June, due to the MU PSR calculation based on the financial results of the Red Football Limited (a subsidiary of the club), they have many large expenses that are not directly related to football activities.

Although there was no financial statements last season, The Athletic estimated that MU could lose up to £ 141 million in the 2024/25 season and still did not violate PSR. With commercial revenue and ticket sales increased sharply (despite the much decrease in royalties) and the salary fund decreased significantly, they may remain losses, but at the level of control, within the permitted threshold of PSR (£ 105 million in 3 years).

Problems of cash flow and payment

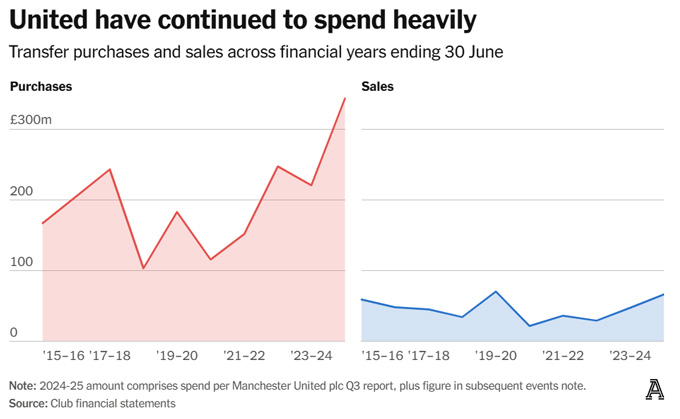

Although PSR seems to be in control, the problem of cash flow is another story. The CunHa deal alone costs £ 71.3 million, recorded in the fiscal year of 2024/25, causing the total expenditure for the 2023/24 season to £ 343.5 million, the third highest level of English football history.

The total net transfer debt (the deducted amount will be received) has skyrocketed from less than £ 100 million (June 2021) to £ 308.9 million (March 2025). Up to that time, MU had to pay 175.5 million pounds before March 2026.

Both CuHa and Mbeumo deals are paid in several phases, helping to reduce short -term pressure but increase the long -term burden. MU once wanted to divide the fees for 5 phases but were rejected by Wolves, showing that they needed to be very cautious with the current cash flow.

Loans and financial rooms

MU is holding a number of rotating credit limits (RCFS – equivalent to business expenditure). After the Covid-19 epidemic, they started using these limits to support liquidity.

At the end of April 2025, MU paid 50 million pounds for current RCF loans – an action that was understood as a clearing of the way for the possibility of borrowing in the summer. At that time, the Red Devils could also borrow £ 140 million within the maximum limit of £ 300 million.

On July 10, a new mortgage was registered at the British business registration agency, named by Bank of America. This is either extending the current loan term, either expanding the new loan limit.

MU declined in detailed comments, only all changes in RCF will be published in the financial statements of the season 2024/25, expected in September.

Cost savings and indirect income

Although he has not sold anyone, MU still earns more than 20 million pounds from the term “followed” when the old player was sold, such as Alvaro Carreras, Anthony Elanga and Maxi Oyedele. They also received 5 million pounds from Chelsea because they did not buy Jadon Sancho, despite MU still had to pay the entire salary of a 25 -year -old player if he did not leave this summer.

Rashford's departure in the form of borrowing, although it does not bring the transfer fee, also helps MU save £ 14 million. The Red Devils are expected to adjust EBITDA (operating efficiency measurement index) for the fiscal year of 2024/25 will increase to 180 to 190 million pounds compared to 147.7 million pounds last season, promising more positive money flow.

Still need to sell, and sell better

Although it is still possible to spend, both inside and outside the club understand that selling players is a must. MU has long been weak in selling players. The growing transfer debt is a clear evidence that they have to improve their output negotiation capacity.

Alejandro Garnacho and Antony are the top two candidates that can bring a large revenue this summer. The potential appearance of Sesko makes Rasmus Hojlund's ability to sell, even though the Danish player has only dedicated 2 years.

Hojlund has a book value of about 43 million pounds. MU is willing to sell for 30 million, which is accepting losses (according to PSR standard), but will help significantly replenish cash.